Life Insurance

Health Insurance

Annuity Investments

Individuals, Employers, and Institutions

Fixed Annuity | Indexed Annuity | Long Term Care

Types of Annuities

An Annuity – is a contract issued by insurance companies, providing income over a specified number of years, or over a entire lifetime.

A FIXED ANNUITY

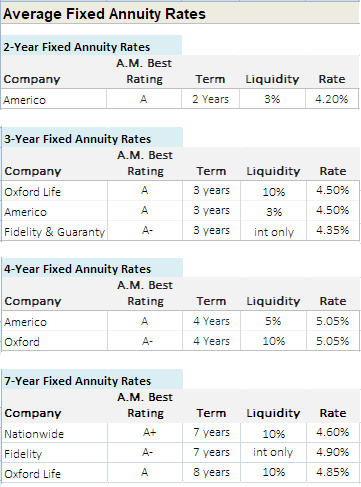

Fixed Annuity – guarantee a specific rate of return, and you will know in advance just how much your Annuity will grow by a fixed interest rate and how much it should pay.

INDEXED ANNUITY

Indexed Annuity – Generally, promises to provide returns based on the performance of an index, with two phases, the accumulation phase, and the pay or distribution phase.

VARIABLE ANNUITY

Variable Annuity – are vested in a variety of sub-accounts that grows on a tax-deferred basis and offers a significantly higher payout potential, when compared to a Fixed Annuity.

Quick Links

Most Jobs Don’t offer a Pension

But did you know…

You can create your own Pension Plan.

Give us a Call, we’ll explain how it works.

ANNUITY INVESTMENT

A Fixed Annuity – is an insurance investment that guarantees your return-on-investment.

Qualified Annuities – are bought with pre-tax dollars as part of a retirement plan, like an IRA.

Non-qualified Annuity – is bought with after-tax dollars rather than pre-tax ‘qualified’ funds.

Immediate Annuity – refers to lump-sum deposits that starts distributing funds immediately.

Deferred Annuity – allows an asset to grow and pays taxes on the capital gains at a later date.

Annuities

A Qualified Annuity – is bought with pre-tax dollars as part of a personal retirement plan like a 401k or an IRA.

A Non Qualifying Annuity – is bought with after-tax dollars rather than as part of a qualified retirement plan.

Income

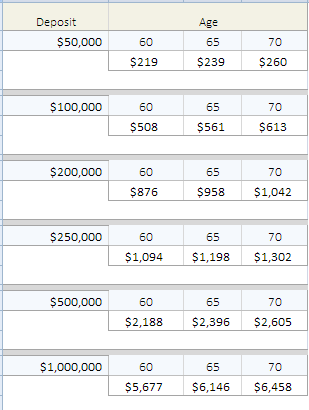

Fixed Annuity

An Annuity – is considered a long-term financial vehicle. You may elect a payout option that guarantees you a certain amount for life, where you & your spouse cannot out-live the payments, even after the original deposit has been exhausted.

Growth

Indexed Annuity

An Indexed Annuity – Generally

promises to provide returns

based on the performance

of an index, and has two phases,

the accumulation phase, and

the distribution phase.

Annuity Options

Purchasing an Annuity – is a solid financial investment for certain situations, and there’s things you should know before going all-in… like how the withdrawls work, or the mandatory distributions (at a certain age), how the death benefit is paid, the Contract Value vs the Surrender Value, and the taxes and tax penalties.

Our Team – is committed to helping you understand how these investments work, before you purchase it, although we cannot offer you legal or tax advice, we can ensure you understand your options, such as: a short-term or long-term investment, or a lump-sum deposit like 401k/ IRA roll-over, or setting-up your account with (pre-tax) contributions per paycheck, very similar to a group-plan retirement contribution.

Double T investments – tailor strategies to meet certain goals, however we cannot offer legal nor tax advice. You must seek an attorney or tax-consultant for those services.

Double T investments

We’re Here to Help.

Individuals, Employers and Institutions

Advisors & Advocates available M-F, 10-6pm

Get in Touch

Contact Us

(888) 396-2411

Email Us

Who we are

Resources

© 1998 – 2025 Double T. Investments. All Rights Reserved.